Enterprise Zones

The State of Maryland’s Enterprise Zone program, established in 1982, provides real property and state income tax credits to businesses that create jobs and make capital investments. Anne Arundel County’s Enterprise Zone covers more than 1,500 acres in the Brooklyn Park area. The goal is to incentivize commercial redevelopment by leveraging public incentives to address vacant properties, as well as encourage business retention, expansion, and job creation.

Benefits

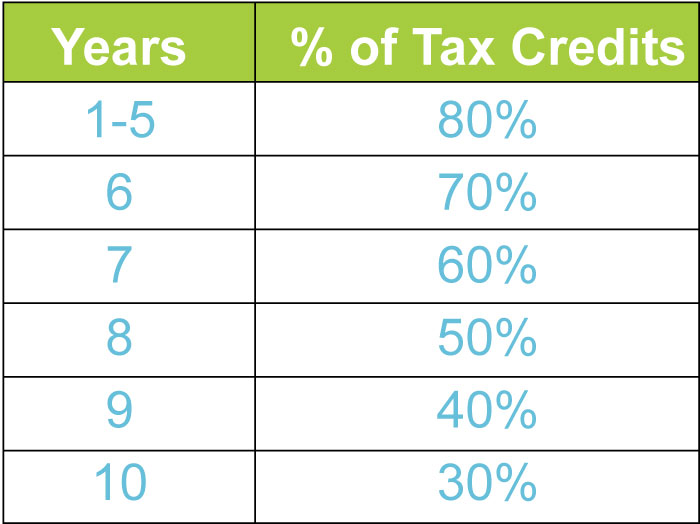

Real property 10-year county and city tax credit based on the increase in real property tax assessments resulting from commercial capital investment. The credit decreases over 10 years, as follows:

One-time $1,000 state income tax credit foreach qualified employee filling a newly created position.

Three-year state income tax credit for each qualified new economically disadvantaged employee, earned at the following amounts:

Eligibility

- Must be established within Anne Arundel County designated 1,572-acre enterprise zone

- To claim the property tax credit, at least $25,000 in capital investment in the enterprise zone must occur

- For the general income tax credit, business must create at least one full-time position (35+hours a week) where employee is paid at least 150% of the federal minimum wage and remains in the position for at least 6 months doing at least 50% of the work time in the enterprise zone

- To claim the income tax credit for hiring economically disadvantaged employees, business must have certification from the Maryland Dept of Labor, Licensing and Regulation and the employee must remain in the position for three years

Click here for a program flier.